flower-kupit.ru

Learn

Savings Account Calculation

It's easy. Simply divide your APY by 12 (for each month of the year) to find the percent interest your account earns per month. Include what you've saved in your TFSAs, GICs and bank accounts. Find ways to maximize your savings. Move your money into a savings account or GIC to earn a. Free calculator to find out the balance and interest of a savings account while accounting for tax, periodic contributions, compounding frequency. As done in most financial calculators, all months are assumed to be of equal length. In reality, many savings accounts accrue on a daily basis leading to a. The formula for calculating compound interest is A = P (1 + r/n)^(nt). The variables for this formula are: A = Total amount; P = Principal or staring amount; r. Our savings interest calculator is a tool to help you figure out how much money you will earn in a year on the funds in your interest-earning account. Try our savings interest calculator to see how much interest you could be earning with a Marcus Online Savings Account vs. other banks. Our savings interest. Small deposits can result in big rewards down the line with an interest savings account. See how much you could have in your account over time. You can calculate the simple interest rate by taking the initial deposit or principal, multiplying by the annual rate of interest and multiplying it by time. It's easy. Simply divide your APY by 12 (for each month of the year) to find the percent interest your account earns per month. Include what you've saved in your TFSAs, GICs and bank accounts. Find ways to maximize your savings. Move your money into a savings account or GIC to earn a. Free calculator to find out the balance and interest of a savings account while accounting for tax, periodic contributions, compounding frequency. As done in most financial calculators, all months are assumed to be of equal length. In reality, many savings accounts accrue on a daily basis leading to a. The formula for calculating compound interest is A = P (1 + r/n)^(nt). The variables for this formula are: A = Total amount; P = Principal or staring amount; r. Our savings interest calculator is a tool to help you figure out how much money you will earn in a year on the funds in your interest-earning account. Try our savings interest calculator to see how much interest you could be earning with a Marcus Online Savings Account vs. other banks. Our savings interest. Small deposits can result in big rewards down the line with an interest savings account. See how much you could have in your account over time. You can calculate the simple interest rate by taking the initial deposit or principal, multiplying by the annual rate of interest and multiplying it by time.

Give us a call at to open a college savings account today. Information provided is for general purposes only and is. This calculator shouldn't be relied on for making a decision in relation to a savings account as you should consider whether the product features suit your. Calculate your savings growth with our high yield savings account calculator. Input your initial deposit, recurring monthly deposits, interest rate. If rates go up annually by %, the long term CD will earn the most over the 3 years · General Info · Savings Account · Short Term CD · Long Term CD. How to calculate your savings · Type in how much you currently have saved. · Decide on a timeline for your savings plan. · Enter your interest rate into the. Savings Calculator ; Savings: $ per month. $1 ; Time: years months. 1 month ; Interest: %. %. Use this compound interest calculator to help determine how much your savings will grow over the years. Specify the initial investment with your plans for. In a straightforward interest calculation, $1, in a savings account that earns 1% interest in one year would yield $1, (or x 1,) at the end of the. A Savings Account Interest Calculator is a financial tool that projects the potential earnings from a Savings Account. Chart your savings account as it goes up, up, up. Use this tool to see how your interest rate pays off in the long term — and how smart, consistent investing. Try our Savings Account Calculator. High-yield savings account rates can help you grow your savings at a higher rate than traditional savings accounts. SAVINGS ACCOUNT INTEREST CALCULATOR · ICICI Bank Savings Account interest rates are fixed. · The interest is calculated as per the daily End Of Day (EOD). The Savings Account Interest Calculator is a quick-and-easy tool to calculate the interest you can earn on your savings account balance. You must enter your. Add the interest rate, or annual percentage yield (APY), you expect to get from the savings account. This is determined by the financial institution, so it'll. Discover how to reach your financial goals with the short-term savings goal calculator from Bank of America. Our savings calculator makes it easy to find out. Using the three sliders at the bottom of the calculator, select your initial deposit, how much you plan to. Funds in Discover Bank deposit accounts are insured for up to $, per depositor for each account ownership category. For help calculating your coverage. High Yield Savings Account Calculator. Visualize the impact of a % yield on your savings over time with a Public High-Yield Cash Account. See how our. Savings Goal Calculator · Required Minimum Distribution Calculator · College Test your knowledge of day trading, margin accounts, crypto assets, and more! The Savings Calculator ; Regular Savings Accounts. Boost the savings rate you get by saving monthly ; How to Start Saving. Maximise the interest you get ; Top.

Google Pixel 3 Esim

![]()

1. In Settings, go to Network & Internet > Mobile Network > Click on "+" · 2. You can now scan your QR code or enter the code manually · 3. When the device asks. III. QR Code Installation · In Settings, TAP Network & Internet. · TAP the + icon next to SIMs. · TAP Download a SIM Instead? · TAP Next and SCAN the QR code found. Does the Pixel 3 have an eSIM? All the Pixel 3 devices (Pixel 3, Pixel 3XL, Pixel 3A, Pixel 3A XL) have an eSIM and are globally enabled, meaning they work. Nano-SIM, eSIM. Weight. oz. Wi-Fi. Wi-Fi a/b/g/n/ac, dual-band. Wireless Charging. Yes. description. Make a statement with the Google Pixel 3 64GB. Google Pixel 3 (not including phones bought in Australia, Taiwan or Japan. Phones bought with US or Canadian carriers other than Spring and Google Fi don't work. International eSIM compatible with Google Pixel 3, immediate eSIM online activation from Countries. Local Internet through mobile data services for. Yes. Since the Google Pixel 3 supports eSIMs, you can have both an eSIM and a physical SIM card active at the same time. The device has a built. Universal eSIM compatible with Google Pixel 3, immediate eSIM online activation from Countries. Local Internet through mobile data services for Google. Your Pixel 3 XL should support eSIM. Let's ensure it's not restricted to any specific carrier or network. 1. In Settings, go to Network & Internet > Mobile Network > Click on "+" · 2. You can now scan your QR code or enter the code manually · 3. When the device asks. III. QR Code Installation · In Settings, TAP Network & Internet. · TAP the + icon next to SIMs. · TAP Download a SIM Instead? · TAP Next and SCAN the QR code found. Does the Pixel 3 have an eSIM? All the Pixel 3 devices (Pixel 3, Pixel 3XL, Pixel 3A, Pixel 3A XL) have an eSIM and are globally enabled, meaning they work. Nano-SIM, eSIM. Weight. oz. Wi-Fi. Wi-Fi a/b/g/n/ac, dual-band. Wireless Charging. Yes. description. Make a statement with the Google Pixel 3 64GB. Google Pixel 3 (not including phones bought in Australia, Taiwan or Japan. Phones bought with US or Canadian carriers other than Spring and Google Fi don't work. International eSIM compatible with Google Pixel 3, immediate eSIM online activation from Countries. Local Internet through mobile data services for. Yes. Since the Google Pixel 3 supports eSIMs, you can have both an eSIM and a physical SIM card active at the same time. The device has a built. Universal eSIM compatible with Google Pixel 3, immediate eSIM online activation from Countries. Local Internet through mobile data services for Google. Your Pixel 3 XL should support eSIM. Let's ensure it's not restricted to any specific carrier or network.

Google Pixel Phones - Enable / Disable eSIM Profile · From a Home screen, swipe up from the middle to display all apps. · Navigate: Settings Settings. Network &. eSIM technology in Pixel 3 XL greatly expands user capabilities, since you do not have to insert a new SIM card in order to activate an additional plan. To download your GoMoWorld eSIM, you need three things. Top tip – do this before you depart for the quickest way to get going: an internet connection (i.e. Wifi. eSIM compatibility is provided by Google's new Pixel 3 series, which includes the Pixel 3a and Pixel 3a XL, as well as the Pixel 3a and Pixel 3a XL. This. Set up an eSIM on your Pixel and switch networks more easily. Use dual SIMs to choose which SIM your phone uses for data, calls, texts, and more. Step 1 of 3. Using a Google Pixel eSIM means you'll have prepaid international data from aloSIM, and you can still call and text on your regular phone number. Buy eSIM. All Things Pixel. Choose the best Pixel phone for you. Wearables. Find the Pixel Watch 3 that fits just right. Photography. Say goodbye to shaky, grainy. The Google Pixel 3xl has an eSIM. To activate it, just ask the operator for a QR code, scan it, and make an advance payment according to the tariff. Google. 1. Find "Network and Internet". Press Network and Internet. Step 4 of 7 · 2. Add eSIM. Press the add icon. Step 5 of 7 · 3. Scan QR code. FAQ Google devices equipped with eSIM · Google Pixel 9 Pro XL · Google Pixel 9 Pro · Google Pixel 9 · Google Pixel 8 Pro · Google Pixel 8 · Google Pixel Fold · Google. So I recently brought a Google pixel 3 (unlocked) expecting it to work with my assurance wireless sim, but when I put the sim in it doesn't work. How do I set up an eSIM on my Google Pixel? · go to Settings > Mobile network > Operator · select Add operator · use your camera to scan the QR code on your eSIM. Learn how to configure, manage and use your Google Pixel 3 with interactive tutorials Pixel 3Setting up your second cellular plan with eSIM. Adding a. Ready to install your new aloSIM eSIM on any eSIM-compatible Google Pixel device? Great! You can choose between three options: Instant QR. Google Pixel 3 - 64 GB - Black (Unlocked) (Dual SIM (SIM + eSIM)** **Excellent Used Condition. Has been in a phone case with a screen protector the entire. Find out how easy your Google Pixel 3 smartphone can support eSIM. Simply insert the flower-kupit.ru Card and start downloading eSIMs online! Google Pixel 3 · eSIM · More carriers to support Pixel 3 eSIM as Google helping build more eSIM Android phones · Avatar for Abner Li Abner Li Dec 3 - This guide will walk you through activating an eSIM on your Pixel 8 phone and migrating an eSIM from an earlier Pixel phone. These steps work for the three. To use eSIM, Google Pixel 3 MUST NOT be bought in Australia, Japan or Taiwan. Phones bought with Canadian or US carriers other than Spring and Google Fi do not. universal eSIM compatible with Google Pixel 3, immediate eSIM online activation from Countries. Local Internet through mobile data services for Google.

Best Wireless Tens Unit

Omega is among the most trusted TENS brands. It uses waveform technology to help block the body's pain signals and release the body's natural pain reliever . Presenting the amazing WiTouch Pro—a wearable drug-free pain management tens machine that will help you lead an active, healthy and productive lifestyle! Effective, drug-free muscle and joint pain relief, in a convenient system. Try the new ET Therapeutic Wearable System, a TENS EMS Muscle Stimulator. "Excellent for pain relief on the go." Ditch those lead wires for one of our more portable TENS units, the AccuRelief wireless TENS machine. Effective, drug-free muscle and joint pain relief, in a convenient system. Try the new ET Therapeutic Wearable System, a TENS EMS Muscle Stimulator. Zarifa has made the best portable TENS unit on the market. You'll notice a difference in how your body and mind feel after the end of a long day when you use a. OMEGA Wireless TENS Unit Muscle Stimulator with Large Touchscreen Remote, 2 Back Pain Relief Pads, 6 Modes, USB Charger - Rechargeable Pain Relief Device for. The Vive wireless TENS device provides targeted relief for acute and chronic pain in the shoulders, arms, waist, back and legs. TENS units may help treat pain by sending small electrical impulses through the nervous system. Here we look at seven of the best units online. Omega is among the most trusted TENS brands. It uses waveform technology to help block the body's pain signals and release the body's natural pain reliever . Presenting the amazing WiTouch Pro—a wearable drug-free pain management tens machine that will help you lead an active, healthy and productive lifestyle! Effective, drug-free muscle and joint pain relief, in a convenient system. Try the new ET Therapeutic Wearable System, a TENS EMS Muscle Stimulator. "Excellent for pain relief on the go." Ditch those lead wires for one of our more portable TENS units, the AccuRelief wireless TENS machine. Effective, drug-free muscle and joint pain relief, in a convenient system. Try the new ET Therapeutic Wearable System, a TENS EMS Muscle Stimulator. Zarifa has made the best portable TENS unit on the market. You'll notice a difference in how your body and mind feel after the end of a long day when you use a. OMEGA Wireless TENS Unit Muscle Stimulator with Large Touchscreen Remote, 2 Back Pain Relief Pads, 6 Modes, USB Charger - Rechargeable Pain Relief Device for. The Vive wireless TENS device provides targeted relief for acute and chronic pain in the shoulders, arms, waist, back and legs. TENS units may help treat pain by sending small electrical impulses through the nervous system. Here we look at seven of the best units online.

This is one of THE best therapeutic units our patients have employed for pain management and muscle strengthening. The ability to utilize 4 independent. WIRELESS TENS UNIT, 15 MODES, PRE-GELLED ELECTRODE PAD, RECHARGEABLE Providing targeted relief, the Vive wireless TENS device is a non-invasive, drug-free. 2 in 1: iReliev TENS + EMS Combination Unit Combines Two Therapies in 1 device. Combining all-natural jade and tourmaline, the iReliev Far Infrared Heating Pad. The iReliev Wireless TENS EMS Unit is the best on the market because it is a versatile, wireless unit that combines TENS and EMS therapy in one product. iReliev. Pharmacists ranked the best TENS unit brands for home use and purchased without a prescription. Omron is their No.1 brand. TENS units may help treat pain by sending small electrical impulses through the nervous system. Here we look at seven of the best units online. The Digital EMS, TENS, IF, and Russian Combo Unit by Roscoe Medical is in the top spot. This impressive four-channel device combines TENS, EMS, IF . Wireless TENS Unit · Pain relief on the go · Self-stick electrode pads for wireless massage · 6 Programmed massage therapy settings · 20 Levels of adjustable. Whether chronic pain or sore muscles, EHE TENS will suit your needs! FDA K cleared for safe home use. An ideal holiday gift for Valentine's Day,Mother's. Dr. Stim | Wireless Best TENS Unit for Pain Relief, EMS Muscle Stimulator, Portable Pain Management Muscle Strength Wearable System, Pulse Massager Unit, Wireless TENS Pain Relief, Portable Electro Pulse Impulse Mini Massager Machine for Lower Back and Neck Pain (With Heating Function). Our simple press-and-play Mini Wireless FDA cleared TENS unit is designed to help you manage pain whether on the go, at the court, or relaxing at home. No wires. People often viewed ; Beurer - Digital EMS + TENS Device - White. User rating, out of 5 stars with reviews. (). $ ; Beurer - Digital TENS +EMS. Customers have good things to say about the wireless convenience and pain relief provided by the Wireless 3-in-1 Pain Relief TENS Unit. They appreciate the. Easy@Home Rechargeable Compact Wireless TENS Unit - K Cleared, FSA Eligible Electric EMS Muscle Stimulator Pain Relief Therapy, Portable Pain Management. As a long time user of wired TENS units, I wasn't sure what to expect with this device. I was pleasantly surprised with the Pure Enrichment PurePulse Go. A TENS machine is a small, battery-operated device that has leads connected to sticky pads called electrodes. White electrode pads stuck above and below the. Our simple press-and-play Mini Wireless FDA cleared TENS unit is designed to help you manage pain whether on the go, at the court, or relaxing at home. No wires. DRUG-FREE PAIN MANAGEMENT. Providing targeted pain relief, the Vive wireless TENS unit is suitable for relieving pain in the shoulder, arms, back, waist and. Wireless TENS Machines ; Back pain relief tens machine. Med-Fit Wireless 2 Channel Tens Machine - 20 Programmes SKU: Painless Duo. 25 reviews ; Med-Fit Solo Mini.

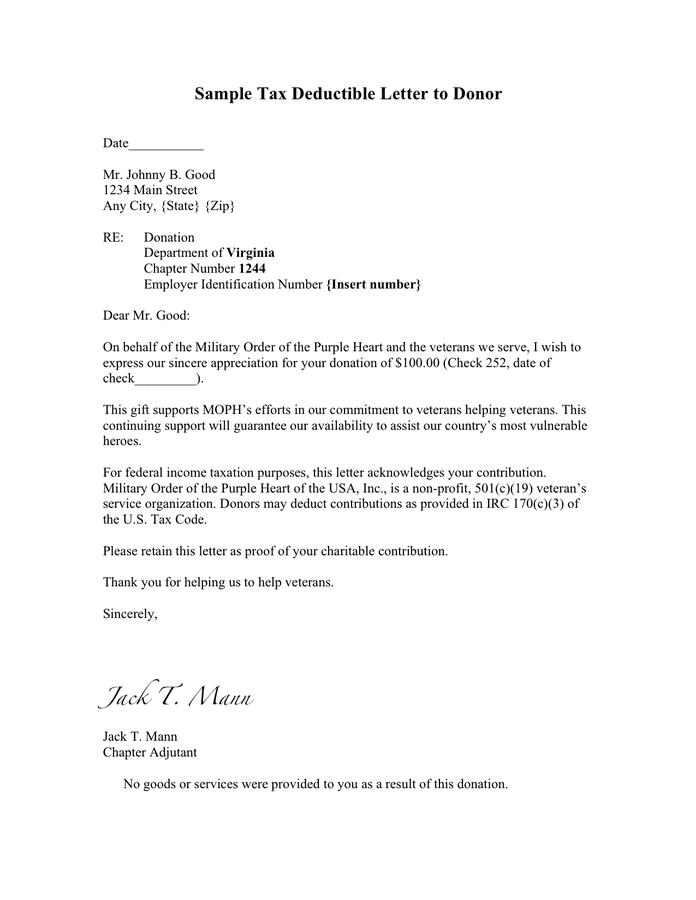

Tax Deductions Non Profit Donations

Eligible donations of cash, as well as items, are tax deductible, but be sure that the recipient is a (c)(3) charitable organization and keep your donation. If you want to take a charitable contribution deduction on your income-tax return, you need to substantiate your gifts. You must have the charity's written. You can take the charity donation tax deduction for your non-cash single charitable donation for one item or a group of similar items is more than $5, if the. A donation of business services or volunteering time does not qualify as a charitable deduction, and, therefore, carries no tax benefit. C Corporations. If. Generally, you may deduct up to 50 percent of your adjusted gross income, but 20 percent and 30 percent limitations apply in some cases. For tax years beginning in , an individual who does not itemize deductions may claim a charitable contribution deduction of up to $ ($ in the case of. By using the proper tax planning strategies, charitable contributions can reduce three kinds of federal taxes: income, capital gains and estate taxes. If you are eligible for a charitable deduction, ensure that you have the proper records. This can include an acknowledgment letter from the charity or a credit. The total deductions are capped at 20% to 50% of a taxpayer's AGI for non-cash contributions and gifts to non-qualifying organizations, including private non-. Eligible donations of cash, as well as items, are tax deductible, but be sure that the recipient is a (c)(3) charitable organization and keep your donation. If you want to take a charitable contribution deduction on your income-tax return, you need to substantiate your gifts. You must have the charity's written. You can take the charity donation tax deduction for your non-cash single charitable donation for one item or a group of similar items is more than $5, if the. A donation of business services or volunteering time does not qualify as a charitable deduction, and, therefore, carries no tax benefit. C Corporations. If. Generally, you may deduct up to 50 percent of your adjusted gross income, but 20 percent and 30 percent limitations apply in some cases. For tax years beginning in , an individual who does not itemize deductions may claim a charitable contribution deduction of up to $ ($ in the case of. By using the proper tax planning strategies, charitable contributions can reduce three kinds of federal taxes: income, capital gains and estate taxes. If you are eligible for a charitable deduction, ensure that you have the proper records. This can include an acknowledgment letter from the charity or a credit. The total deductions are capped at 20% to 50% of a taxpayer's AGI for non-cash contributions and gifts to non-qualifying organizations, including private non-.

Itemize your deductions on your tax return if you think your total donations will exceed your standard deduction1 and you want to receive a tax benefit for your. You can deduct charitable contributions from your taxable income—if you follow IRS rules about documenting your gifts. Generally, a donor may deduct an in-kind (or, non-cash) donation as a charitable contribution. And a donor must obtain a written acknowledgment from the. Now, a deduction for charitable donations—whether for cash donations or donating goods—is only available to those who itemize. Qualified charitable. If you itemize deductions, gifts of cash to qualified public charities can be deducted in an amount up to 60% of your adjusted gross income (AGI) in a given. When you donate cash an IRS-qualified (c)(3) public charity, you can generally deduct up to 60% of your adjusted gross income. Giving money to charity allows you to make a tax deduction that could reduce the amount you owe on your taxes. There are no rules on who can donate — anyone can. Charitable contributions must be claimed as itemized deductions on Schedule A of IRS Form The limit on charitable cash contributions is 60% of the. How to claim a charitable contribution deduction using Form You'll use IRS Tax Form to report information about tax-deductible donations of non-cash. There is no specific dollar limit on deductions from charitable contributions. Generally, you can deduct your donations up to 60% of your annual gross income . When your business donates to charity, it can claim a tax deduction against income. On the other hand, you claim a tax credit if you make a personal donation. To claim charitable donations, you'll need to itemize your deductions on your tax return instead of taking the standard deduction. List your total itemized. Many nonprofit institutions are exempt from paying federal income tax, but taxpayers may deduct donations to organizations set up under Internal Revenue. The Internal Revenue Service requires that all charitable donations be itemized and valued. Here are some handy IRS tips for deducting charitable donations. Contributions You Can Deduct · Churches, synagogues, temples, mosques, and other religious organizations · Federal, state, and local governments, if your. Resident taxpayers subject to the tax may deduct the amount of their charitable donations in excess of $, annually, subject to an annual limit of $, The rule here is: Your contribution is deductible to the extent it exceeds the fair market value of the benefits or privileges you receive. In other words, if a. The deduction for cash donations is generally limited to 60% of your federal adjusted gross income (AGI). However, that percentage drops for certain types of. The standard deduction has more than doubled since However, charitable donations are still tax deductible, for those who itemize. So even though the. You can take a tax deduction for charitable donations made to a qualified organization. You may donate between 1% and 2% of your annual income.

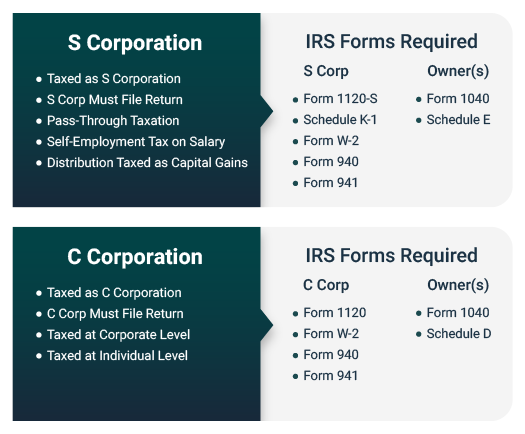

C Corporation Vs S Corporation Difference

A C corp is a separate tax status, with income and expenses taxed to the corporation. If corporate profits are then distributed to owners as dividends, owners. LLCs and C corporations are the two primary corporate entities in the United States. Each entity type has some features that are more advantageous for some. The difference between an S and a C corp involves the way they pay taxes under the Internal Revenue Code. A C corp files its own income tax return and pays. What Are the Main S Corp vs. C Corp Tax Disadvantages? S corporations may not be subject to double taxation, but the IRS watches their tax filings closely. So. The biggest difference between C and S corporations is taxes. AC corporation pays tax on its income, plus you pay tax on whatever income you receive as an. The S-corporation is a vehicle that many business owners use to reduce the amount they contribute to Social Security and Medicaid. An S corporation is subject to the provisions of Subchapter S of the Internal Revenue Code, and C corporations are taxed under Subchapter C of the code. An S corp is a business structure and tax election that allows the business to pass through all its income as well as any deductions, credits and losses to its. This structure is much more traditional than that of an S Corp. Any gains or profits made by the business are distributed to the shareholders to be taxed twice. A C corp is a separate tax status, with income and expenses taxed to the corporation. If corporate profits are then distributed to owners as dividends, owners. LLCs and C corporations are the two primary corporate entities in the United States. Each entity type has some features that are more advantageous for some. The difference between an S and a C corp involves the way they pay taxes under the Internal Revenue Code. A C corp files its own income tax return and pays. What Are the Main S Corp vs. C Corp Tax Disadvantages? S corporations may not be subject to double taxation, but the IRS watches their tax filings closely. So. The biggest difference between C and S corporations is taxes. AC corporation pays tax on its income, plus you pay tax on whatever income you receive as an. The S-corporation is a vehicle that many business owners use to reduce the amount they contribute to Social Security and Medicaid. An S corporation is subject to the provisions of Subchapter S of the Internal Revenue Code, and C corporations are taxed under Subchapter C of the code. An S corp is a business structure and tax election that allows the business to pass through all its income as well as any deductions, credits and losses to its. This structure is much more traditional than that of an S Corp. Any gains or profits made by the business are distributed to the shareholders to be taxed twice.

S Corps are ideal for smaller businesses that want to avoid double taxation, while C Corps may be able to access lower corporate tax rates. The key difference between an S corporation and a C corporation is how they are taxed. C corporations are subject to double taxation. S corporations may be better suited for smaller-sized businesses, since they can have no more than shareholders participating as owners of the company. C. S-corp vs. C-corp compared ; Taxation: gains, Shareholders pay taxes on gains on their individual tax returns. Corporations pay income taxes at a flat rate of The main difference between an S Corp and a C Corp is how they're taxed. C Corp status business owners pay taxes twice — at the corporate and individual level. You don't pay taxes on the corporate level: Whereas with the C corp you pay taxes twice, once at the corporate level and again on the personal level, with an S. How C-Corporations and S-Corporations Compare ; Taxed Twice - Subject to double taxation (taxed at corporation and personal levels), ✓ ; OWNERSHIP (learn more). Difference 3. Ownership. A C-corporation will give you more options when it comes to selling stock. According to the IRS, a corporation that chooses S. A C-Corporation is taxed on its profit at the entity level at the applicable corporate tax rate. There is no pass through taxation. The main difference between a C corporation and an S corporation is the taxation structure. S corporations only pay one level of taxation: at the shareholder. Two common choices are S corporations (S corps) and C corporations (C corps). A corporation may have pass-through taxation or double taxation, depending on. Both a C corp and an S corp offer limited liability protection, and the process of incorporation is similar for both. The main differences relate to taxation. Both corporation formats are governed by similar provisions regarding ownership and capital generation. They are separate legal entities that provide limited. The main difference is in how you are taxed. A C Corp has what is referred to as a double taxation. First, the corporation itself is taxed on the profits it. C corporations and S corporations are different tax designations available to corporations. Each has its pros and cons, and the best choice for you will depend. Each S corporation shareholder must be a U.S. citizen or resident. C corporations can have multiple classes of stock, while S corps are limited to one class of. S Corporation would automatically convert to a C Corporation upon a public offering because of the number of shareholders. (D)Although the public markets are. C corps and S corps can both raise money by selling equity in the company. C corps often raise money by going public, but an S Corp will need to find individual. Taxes Paid by the C Corp C Corp pays taxes for itself, Tax Pass-Through Owners pay taxes for the S Corp ; Unlimited Shareholders, Limited Number of Shareholders. Probably the biggest difference is taxation. A C Corp is taxed based on the income it earns. A S Corp is not (state level 'franchise' fees.

Can You Get Free Domains

With GoDaddy, you get more than a free domain. We have everything you need to take your business or idea further. Free 24/7 support from web pros. flower-kupit.ru offers over 44 domains free with any Google Workspace product. With our domain search, you can find the perfect domain extension, check. But there are also four main ways to get a free domain name: through your website builder, an email host, a WordPress site host, or a free domain registrar. We'. There are a few trusted domain name registrars where you can get your website's domain for free. The only issue with a free domain is that it would not be one. You do need to have a web hosting plan to put your site online, but you don't need to have hosting to purchase a domain. Assuming you have a business or blog. Check if there is still your desired domain under the free domains. You can register this free domain immediately. Get a domain name for free through a hosting service. The deal includes free domains flower-kupit.ru,.net,.tech,.store, and other TLDs. A maximum number of 10 domains can be registered within one single transaction. To register more domains in one transaction use the Freenom API and become a. Not all domains can be registered for free. A limited number of domains are considered "Special" and can only be purchased. Their price varies and pricing is. With GoDaddy, you get more than a free domain. We have everything you need to take your business or idea further. Free 24/7 support from web pros. flower-kupit.ru offers over 44 domains free with any Google Workspace product. With our domain search, you can find the perfect domain extension, check. But there are also four main ways to get a free domain name: through your website builder, an email host, a WordPress site host, or a free domain registrar. We'. There are a few trusted domain name registrars where you can get your website's domain for free. The only issue with a free domain is that it would not be one. You do need to have a web hosting plan to put your site online, but you don't need to have hosting to purchase a domain. Assuming you have a business or blog. Check if there is still your desired domain under the free domains. You can register this free domain immediately. Get a domain name for free through a hosting service. The deal includes free domains flower-kupit.ru,.net,.tech,.store, and other TLDs. A maximum number of 10 domains can be registered within one single transaction. To register more domains in one transaction use the Freenom API and become a. Not all domains can be registered for free. A limited number of domains are considered "Special" and can only be purchased. Their price varies and pricing is.

At GoogieHost, we believe in cost transparency, and if we promise to give a free domain along with free hosting, we fulfill it. We have hosted numerous. You still have to pay for hosting (which you can lock in for under $3 per month), but you get the domain name for free. You can create a Hostinger account and. The Namecheap Education Program offers a free domain and website to university students worldwide. Domains purchased through Shopify are registered for one year, and can be renewed annually. After you buy a domain, you can't change the URL that you chose. They often have deals where they will give you a domain name for free once you sign up and pay for their website hosting. Remember, domains are used for email addresses and websites. You can have a custom email address even if you decide to do nothing else with your domain. With. How do I get a free domain name? You can get a free domain name for your first year in two ways: By selecting one of the extensions covered by this offer; By. You can have a free domain name registration with some of our hosting packages. Check domain availability. What is TLD / SLD / ccTLD / ccSLD? TLD is short. The number of included flower-kupit.ru domain names depends on the chosen web hosting plan and ranges from 3 (in Free plan) and up to 50 domains free in Business. flower-kupit.ru domains will likely have a registration fee - details of this will be clear once flower-kupit.ru registry finalises and shares their launch plan. If you. Generally speaking, no, you cannot get a domain name for free. Some web hosts will offer you a free domain name if you signup for their plan. You can now manage all your domains, free or paid, from one single interface: at Freenom. We support generic top level domains, such as COM, NET and ORG, but. The included free domain helps get your web project set up and online in no time. There are a number of free hosts available who can help you create a website. It's easy to find free and discounted domains at flower-kupit.ru Score a free domain when you purchase web hosting or take advantage of our regular domain discounts. Do not have your own domain registered yet? No troubles! You can choose our free subdomains. We support all international domains too. On the other hand, if you. Get free domain hosting. Wix offers free and secure web hosting with advanced security monitoring, automatic setup, and % uptime for maximum reliability. Purchase any annual flower-kupit.ru plan to receive a free domain credit, which you can use for one of the following options. domains or transfer existing domains to Cloudflare Registrar If you believe you have a legitimate interest to access the registration. Register your fully functional domain for websites, emails, FTP servers, and SSL absolutely free. Unlike other free domain offers, there are no obligations. Hostgator does not offer any free domains by themselves. Hostgator offers a coupon that gives a discount of 20% off for domain registrations. By using a coupon.

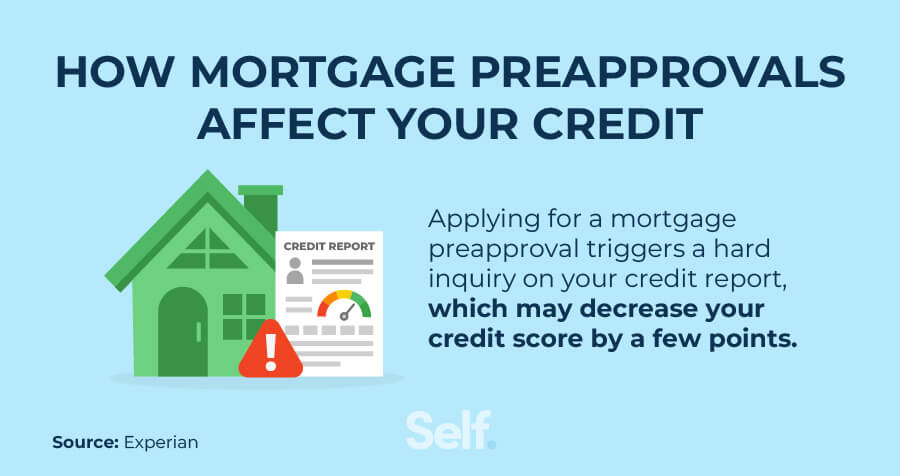

Does A Mortgage Help Your Credit

A higher credit score may help you get better mortgage rates. Learn more at Better Money Habits about mortgage rates and what credit score you need for a. Having a mortgage in good standing appear on your credit report will probably increase your credit score. You may not want to do so for reasons I will get. Every passing month in your home with a mortgage loan should improve your credit. How Home Improvement and Renovation Projects Affect Your Credit Score. If you're successful in securing a loan from a financial institution (such as a bank or credit union) while enrolled in a mortgage assistance program, your. A credit freeze prevents others—including mortgage lenders—from accessing your credit report, so don't take this step lightly. However, if you're dealing with a. Because good credit scores tell mortgage lenders that you're a safe bet to repay a loan, they may reward you for reducing their risk. A credit score above Paying your mortgage is a great way to boost your credit score. It shows lenders that you can borrow a large sum of money and pay it back on time. Your score is critical in determining not only whether you'll secure a loan for a home, but also what interest rate you will be offered. What Happens to Your Credit After You're Approved for a Loan? Your mortgage will appear on your credit reports and will affect your credit score. Overall. A higher credit score may help you get better mortgage rates. Learn more at Better Money Habits about mortgage rates and what credit score you need for a. Having a mortgage in good standing appear on your credit report will probably increase your credit score. You may not want to do so for reasons I will get. Every passing month in your home with a mortgage loan should improve your credit. How Home Improvement and Renovation Projects Affect Your Credit Score. If you're successful in securing a loan from a financial institution (such as a bank or credit union) while enrolled in a mortgage assistance program, your. A credit freeze prevents others—including mortgage lenders—from accessing your credit report, so don't take this step lightly. However, if you're dealing with a. Because good credit scores tell mortgage lenders that you're a safe bet to repay a loan, they may reward you for reducing their risk. A credit score above Paying your mortgage is a great way to boost your credit score. It shows lenders that you can borrow a large sum of money and pay it back on time. Your score is critical in determining not only whether you'll secure a loan for a home, but also what interest rate you will be offered. What Happens to Your Credit After You're Approved for a Loan? Your mortgage will appear on your credit reports and will affect your credit score. Overall.

That last mortgage payment is certainly cause for celebration and is a huge accomplishment. That's why your credit score should experience a triumphant leap. Your credit score plays a big role in your mortgage rate. The higher your score, the lower your rate — and the more money you stand to save. Although most lending programs cap your DTI at 45%, a high credit score may allow exceptions up to 50%. You can reduce mortgage insurance costsIf you can't. Your credit score holds important weight in a mortgage approval and interest rate because it's directly tied to your credit history. In this case, your credit won't be dinged multiple times. With mortgages, you can get your credit report pulled by additional lenders with no further impact to. If your credit score is in the highest category, , a lender might charge you percent interest for the loan.1 This means a monthly payment of $ A higher FICO® credit score can offer lower rates and access to competitive home loan programs. Improve your credit rating for a mortgage with these 5 tips. A higher credit score may mean lower interest rates and more choices on a mortgage because lenders use your credit score to help decide whether they'll approve. Your credit score plays a major role in the mortgage approval process; it dictates what types of loans you're eligible for, how much money you're expected. Refinancing your mortgage can be a great way to lower your interest rate and reduce your monthly mortgage payment, but it can also impact your credit scores. Ulzheimer says it makes perfect sense that your FICO score would remain largely untouched after you pay off your mortgage loan. While it's true that paying off. When you buy a home, getting a mortgage could help your credit. Once you're approved for the home loan and make regular payments on it, you're likely to see. The effect of a mortgage inquiry on your credit score is small. Here's why: Your FICO® Score is typically used (credit scores rank from ) with a mortgage. Along with mortgage rates and down payments, credit scores could also affect the private mortgage insurance, or PMI, premium you pay if required. PMI insures. What credit score do you need to buy a house? We'll cover why credit scores matter in the mortgage process and how to maximize your score. A credit score. If your credit score is in the highest category, , a lender might charge you percent interest for the loan.1 This means a monthly payment of $ Cosigning a mortgage does not directly affect your credit, but if a payee defaults on payments your score could be affected. Your credit score shows lenders how likely you are to make payments on time and manage your finances. In general, the higher your credit score is, the better. There's one key step you should take to boost your odds of landing your dream home: getting preapproved for a mortgage loan with a lender. If you do this.

Best Place To Open A Joint Savings Account

Opening a joint bank account is similar to setting up individual accounts. Most banks will allow you to sign up online or in person as long as you have the. Save money with someone else and we'll help you reach your goals quicker. Browse our best Lloyds Bank joint savings accounts. A joint savings account from Santander can help you reach shared financial goals. Learn more about the benefits and how to open a joint savings account. The one where you ask each other if you should combine your financials accounts now that you're sharing a household. There is no one-size-fits-all solution for. Joint account holders welcome! · Accounts cost just $10 to open: $5 one-time membership fee, plus a $5 share in the credit union (refunded if you close your. Many couples open a joint bank account to make it easier to pay shared bills and expenses, or to help save toward mutual financial goals – such as buying a. SoFi joint bank accounts have no account fees, unlimited transfers, and high APY. See why SoFi was voted the Best Joint Checking Account of Learn about the benefits of a Chase savings account online. Compare Chase savings accounts and select the one that best suits your needs. TD Joint Bank Accounts Opening a joint checking or savings account with someone close to you can help you spend, save and monitor money more efficiently. Opening a joint bank account is similar to setting up individual accounts. Most banks will allow you to sign up online or in person as long as you have the. Save money with someone else and we'll help you reach your goals quicker. Browse our best Lloyds Bank joint savings accounts. A joint savings account from Santander can help you reach shared financial goals. Learn more about the benefits and how to open a joint savings account. The one where you ask each other if you should combine your financials accounts now that you're sharing a household. There is no one-size-fits-all solution for. Joint account holders welcome! · Accounts cost just $10 to open: $5 one-time membership fee, plus a $5 share in the credit union (refunded if you close your. Many couples open a joint bank account to make it easier to pay shared bills and expenses, or to help save toward mutual financial goals – such as buying a. SoFi joint bank accounts have no account fees, unlimited transfers, and high APY. See why SoFi was voted the Best Joint Checking Account of Learn about the benefits of a Chase savings account online. Compare Chase savings accounts and select the one that best suits your needs. TD Joint Bank Accounts Opening a joint checking or savings account with someone close to you can help you spend, save and monitor money more efficiently.

A Wells Fargo Kids Savings Account is a good way to teach children how to save. Open an account at one of our retail banking stores. How to open a joint bank account · Choose a Chequing or Savings account. Review our Chequing and Savings accounts to decide which account type is the best fit. A joint account is a deposit owned by two or more individuals that satisfies the requirements set forth below. II. Insurance Limit. Each co-owner of a joint. Opening a joint account with your child is a smart way to teach them financial responsibility. The U.S. Bank Smartly ® Checking account offers special benefits. Just find a nice local community bank. If you have stacks of cash, online high yield savings is great. Compare checking accounts · View savings accounts and rates. What do I need What do I need to open a joint account?Expand. To open a joint account, you. Joint bank accounts aren't just for married couples. There are many situations where it might work to each party's advantage to merge rather than maintain. SoFi Checking and Savings Account. Axos Bank Essential Checking. Aspiration Spend and Save Account. nbkc Bank Everything Account. LendingClub Rewards Checking. Easier to keep track of household expenses like bills, food, rent or mortgage so you can budget more easily. Two sets of income going into the account could. Compare Savings Accounts · Personal Borrowing · Personal everblue Credit Open a single, joint, or multiple accounts, elect options like debit cards. Exploring bank accounts together is also a good opportunity to get comfortable talking about money. As you compare features that come with different accounts. If you plan to do it in person, both account holders will need to be present. Regardless of where or how you open your account, you'll need to provide basic. While couples often share savings and investment accounts, too, a joint checking account can be a good place to start. Key Takeaways. Couples, parents with. Better to go your separate ways banking-wise than to separate down the road because of bickering over bitterly contested dimes. If you already have a joint bank. It's best to agree on these things upfront and to communicate regularly to make sure you both know how much and where you're spending. Think about a joint. All our accounts can be opened jointly. Simply select the Joint option when applying. Learn what you'll need to apply online. best for you. What information do I need to open a joint account? You'll need the same information that's needed when opening an individual account, but you. Can unmarried couples open joint accounts? One of the most common ways for couples to combine finances is by opening a joint bank account where both parties can. Compare interest rates on flexible savings accounts. We don't offer standalone joint savings accounts; However, you can still compare a variety of savings. What does it mean to have a joint account through Raisin? As a Raisin customer, you have one account where you can view all the deposit products you own. Let's.

Intuit Freefile

Most taxpayers can prepare and e-file their Wisconsin income tax return for free using Wisconsin e-file flower-kupit.ru, Form 1, Form 1 w/H, Form. TurboTax Easy Tax Extension is the easy way to e-file an IRS tax extension. Easily file a personal income tax extension online and learn more about filing a. If you have a Form return and are claiming limited credits only, you can file for free yourself with TurboTax Free Edition. As of the tax filing season, the two most used tax-filing software programs (TurboTax and H&R Block) no longer participate in the Free File program. With. Intuit has elected not to renew its participation in the IRS Free File Program and will no longer be offering IRS Free File Program delivered by TurboTax. Learn more about how you can file your taxes FOR FREE with UFirst Credit Union and Intuit TurboTax. You Can File Simple Returns for Free. Taxpayers who need to file a state return AND qualify to prepare and file their federal return for free with Intuit TurboTax Free File Program. E-Filing Through a Paid Preparer ; Intuit Inc. ProConnect Tax Online ; Intuit Inc. Lacerte ; Intuit Inc. ProSeries ; Intuit Inc. TurboTax ; Jackson Hewitt Tax. View TurboTax Online pricing and benefits. File your own taxes with confidence. Start for Free and pay only when you file. Max refund and % accurate. Most taxpayers can prepare and e-file their Wisconsin income tax return for free using Wisconsin e-file flower-kupit.ru, Form 1, Form 1 w/H, Form. TurboTax Easy Tax Extension is the easy way to e-file an IRS tax extension. Easily file a personal income tax extension online and learn more about filing a. If you have a Form return and are claiming limited credits only, you can file for free yourself with TurboTax Free Edition. As of the tax filing season, the two most used tax-filing software programs (TurboTax and H&R Block) no longer participate in the Free File program. With. Intuit has elected not to renew its participation in the IRS Free File Program and will no longer be offering IRS Free File Program delivered by TurboTax. Learn more about how you can file your taxes FOR FREE with UFirst Credit Union and Intuit TurboTax. You Can File Simple Returns for Free. Taxpayers who need to file a state return AND qualify to prepare and file their federal return for free with Intuit TurboTax Free File Program. E-Filing Through a Paid Preparer ; Intuit Inc. ProConnect Tax Online ; Intuit Inc. Lacerte ; Intuit Inc. ProSeries ; Intuit Inc. TurboTax ; Jackson Hewitt Tax. View TurboTax Online pricing and benefits. File your own taxes with confidence. Start for Free and pay only when you file. Max refund and % accurate.

file Illinois individual income tax returns and corresponding forms and schedules. Website: flower-kupit.ru On-Line Taxes, Inc. Product Name. TurboTax's Free Canadian software costs $0 and is ideal for various tax situations. Start filing your secure tax return for free. In , Intuit spent approximately $, on paid search advertising to promote the Free File Program when a taxpayer searched for “TurboTax. Page 9. 8. See how TurboTax Free Edition and H&R Block Free Online tax filing stack up. TurboTax is a registered trademark of Intuit, Inc. Was this topic helpful. Roughly 37% of taxpayers are eligible. If you have a Form return and are claiming limited credits only, you can file for free yourself with TurboTax Free. Why use TurboTax Free Edition? · File your federal & state taxes for free · Ideal for. W-2 income · Maximize tax credits for dependents · Get the green. TurboTax® Canada can help get your past taxes done right. TurboTax® makes it easy to prepare and file prior-year tax returns online for , FreeTaxUSA is a great alternative to high priced tax software such as TurboTax and H&R Block. Easy to use and a fraction of the cost of the other alternatives. File on your own with TurboTax Self-Employed to uncover rideshare-specific deductions, helping you keep more of the money you earn. Or file with TurboTax. Under a certain amount is free for anyone using IRS free file. Everyone can get free federal and $15 state taxes. You may be able to file your federal and state taxes for free with TurboTax Free Edition. Roughly 37% of tax filers are eligible. See if you qualify. Reminder: When Free File Fillable Forms closes after October 20, , you will not be able to access your account to e-file, print or review your information. Age: 18 or older. Intuit TurboTax. FREE Federal and MI (including City of Detroit) tax preparation and e-file. No limitations. Intuit with questions. The settlement applies to certain consumers who paid Intuit to file their federal tax returns through TurboTax for tax years What counts as active duty? Login or Create a new account here: flower-kupit.ru (formerly TurboTax Free File Program, or TurboTax Freedom Edition). H&R Block Free Online includes more tax forms than the TurboTax Free Edition, meaning people can file more situations for free with H&R Block Online. Corporate Income and Franchise; Partnership Income; Estates and Trusts NC Free File · Direct File. Contact Information. North Carolina Department of. Attorney General Henry Announces $ Million Settlement for Millions of Americans Deceived by TurboTax Owner Intuit. May 4, Eligible consumers include. FREE resources for Virginia Income Tax Assistance (VITA) through Free File Partners. Free File Partners provide tax software through TaxAct, Intuit-TurboTax. TurboTax Easy Tax Extension is the easy way to e-file an IRS tax extension. Easily file a personal income tax extension online and learn more about filing a.

Your Wallet App

Learn how to download digital pkpass cards to Android devices through YourWallet, a safe and free mobile wallet. For Apple iOS, our app is supported in iOS 13 and above. For Android, we support OS and above. What's in your flower-kupit.ru Wallet. Your flower-kupit.ru Wallet is a lot like. Google Wallet gives you fast, secure access to your everyday essentials. Tap to pay everywhere Google Pay is accepted, board a flight, go to a movie, and more. Tangem. Your wallet. · Smart backup. · Discover the power of crypto with the Tangem app. · Access to thousands of digital assets. · Meet Tangem Chip. · Stay. In the Ticketmaster app, sign into your My Account. 2. Tap My Events to locate your order. 3. Tap your order to view tickets. 4. Tap on Add to Apple Wallet. It's not a wallet. It's Google Wallet. Set up payment methods Download. Only available on Android. Scan to get the app. Google Wallet Logo. Follow us. Wallet is an app that can store your credit and debit cards, transit cards, event tickets, car keys, driver's license or state ID, and more. Now, confirm the first and last words of your recovery phrase to confirm your backup. Step 6: All done - your Coinbase Wallet is ready! Import or recover an. Google Wallet gives you fast, secure access to your everyday essentials. Take the train, tap to pay in stores, and more with your digital wallet. Learn how to download digital pkpass cards to Android devices through YourWallet, a safe and free mobile wallet. For Apple iOS, our app is supported in iOS 13 and above. For Android, we support OS and above. What's in your flower-kupit.ru Wallet. Your flower-kupit.ru Wallet is a lot like. Google Wallet gives you fast, secure access to your everyday essentials. Tap to pay everywhere Google Pay is accepted, board a flight, go to a movie, and more. Tangem. Your wallet. · Smart backup. · Discover the power of crypto with the Tangem app. · Access to thousands of digital assets. · Meet Tangem Chip. · Stay. In the Ticketmaster app, sign into your My Account. 2. Tap My Events to locate your order. 3. Tap your order to view tickets. 4. Tap on Add to Apple Wallet. It's not a wallet. It's Google Wallet. Set up payment methods Download. Only available on Android. Scan to get the app. Google Wallet Logo. Follow us. Wallet is an app that can store your credit and debit cards, transit cards, event tickets, car keys, driver's license or state ID, and more. Now, confirm the first and last words of your recovery phrase to confirm your backup. Step 6: All done - your Coinbase Wallet is ready! Import or recover an. Google Wallet gives you fast, secure access to your everyday essentials. Take the train, tap to pay in stores, and more with your digital wallet.

Here's a step-by-step guide to help you add your digital card to your wallet app on both iOS and Android devices. Samsung Wallet lets you organize all your essentials into a single app — from important credentials like credit cards, ID cards, bank accounts and passwords to. Cool city passes, I'll have to try that when I visit Chicago. Is this from the app or on the website? Choose your Wells Fargo debit or credit card when you check out in-store, in-app, or online. Fingerprint illustration. Uniquely yours. Confirm your identity. The Wallet app lives right on your iPhone. It's where you securely keep your credit and debit cards, driver's license or state ID, transit cards, keys, event. A digital wallet is an app that stores your credit, debit and gift card information so you can make purchases with your mobile device. Use your smartphone to pay quickly and easily at thousands of places with your Bank of America corporate card via Mobile Wallet. It's faster, simpler and. Secure and User-Friendly Crypto Wallet for NFTs and Digital Tokens. Dive into DeFi and Blockchain Seamlessly. your SBW debit card or other credit card information to your “wallet” and enjoy an easy way to pay. Start by downloading the wallet app of your choice. Add. Most digital wallets come with an app you can add to your computer, phone, watch or other smart device. When you're out shopping, you can pay with most mobile. You can save your payment cards on Google Pay Wallet and use it in stores or to make secure online purchases. Follow the setup instructions. You can add, move, or remove cards, passes, tickets, keys, and IDs to Google Wallet: In the app; Online; In other apps with the “Add to Google Wallet”. Hold your phone up to the symbol on the contactless terminal. Setting up your Digital Wallet to use in-app and online. Step. Enrich your UX Bring powerful new experiences to life with our innovative tooling. alt="". Go modular. Choose from a suite of SDKs and APIs for wallet and app. Digital wallets & mobile payments. Add your Capital One card to a digital wallet for fast, secure payments. With your ID in Wallet, there's no need to reach for your physical ID. Simply add it to the Wallet app and use it to show proof of age or identity. PS4 Add Funds screen, with Current Wallet Funds shown in the upper right. PlayStation App: Check wallet balance. Select the PlayStation Store icon at the. Meet the Chipolo ONE Spot key finder and the new Chipolo CARD Spot wallet tracker! Looking for your missing keys or lost wallet again? Let's help you find a bitcoin wallet. Answer the following questions to create a list of wallets that meet your needs. App. M. Downloads. Rating. 20+. Languages. 15 K. Banks Connect Building a picture of all your assets, monitoring your money and controlling your.