flower-kupit.ru

News

Change Management For New Technology Implementation

Assigning clear roles and mapping out a solid change management strategy can help you fully understand, plan, implement and communicate any changes in a way. Technology plays an increasingly important role in supporting change management initiatives. Various software solutions are available to help. A change management strategy is a defined framework and set of protocols that organizations can rely on when making fundamental shifts to internal operations. As technologies advance, markets adapt, and businesses grow, organizations' IT infrastructures need to be able to evolve to address new needs. A digital transformation initiative is bound to underachieve if it isn't implemented well. You can't just install new tech and hope your employees will receive. To get the biggest benefits from new software, it's well worth the effort to ensure as smooth a transition as possible. VP of Delivery Diego Espada works with. Change management for technology adoption takes two forms—ones that require user buy-in or adoption and ones that don't. The former means alerting users that a. The change challenge that faces IT and other departments when new technology initiatives are introduced is to engage the staff most impacted, exactly those who. There's no doubt that change is stressful. The key is to reduce as much user stress as possible. Successful change management begins within an understanding of. Assigning clear roles and mapping out a solid change management strategy can help you fully understand, plan, implement and communicate any changes in a way. Technology plays an increasingly important role in supporting change management initiatives. Various software solutions are available to help. A change management strategy is a defined framework and set of protocols that organizations can rely on when making fundamental shifts to internal operations. As technologies advance, markets adapt, and businesses grow, organizations' IT infrastructures need to be able to evolve to address new needs. A digital transformation initiative is bound to underachieve if it isn't implemented well. You can't just install new tech and hope your employees will receive. To get the biggest benefits from new software, it's well worth the effort to ensure as smooth a transition as possible. VP of Delivery Diego Espada works with. Change management for technology adoption takes two forms—ones that require user buy-in or adoption and ones that don't. The former means alerting users that a. The change challenge that faces IT and other departments when new technology initiatives are introduced is to engage the staff most impacted, exactly those who. There's no doubt that change is stressful. The key is to reduce as much user stress as possible. Successful change management begins within an understanding of.

Technology is constantly evolving. And while technology lies at the heart of change and innovation, on its own it's not enough to drive effective. It refers to how companies handle modifications, such as the implementation of new technology, adjustments to existing processes, and shifting organizational. The impetus of any organizational change initiative is to improve some aspect of operations or longer term outcomes. Change projects result in new policies. Change management is continually evolving, with new technology playing an increasingly significant role. AI and machine learning are being used to predict and. IT Change Management minimizes risk while making changes to systems and services. Learn about the change management process, its importance, best practices. While not a new technology, IT change management is an essential for In new organizations, IT change management should be implemented as soon as. For example, in technology implementations, specific actions include establishing and communicating the business case for change, ongoing relationship building. As technologies advance, markets adapt, and businesses grow, organizations' IT infrastructures need to be able to evolve to address new needs. Technological change – It involves introducing new technologies or systems in an organization. It can include software implementation or complete digital. Purpose: The purpose of IT Technical Change Management is to prevent unintended consequences and ensure that changes or alterations to systems are implemented. Tracking metrics such as feature usage and support requests on top of this can indicate how easy – or hard – people are finding the new technology. Improved. Also, consider how artificial intelligence (AI) drives change management to find new change management process if you are unsure how to implement data. Organizational Change Management for Software Implementation Your business, just like the world around you, is constantly changing. Think back over the past. Whether it's adopting new technology, restructuring departments, or implementing new policies, a successful change management process can make all the. Technology is constantly evolving. And while technology lies at the heart of change and innovation, on its own it's not enough to drive effective. Technology plays an increasingly important role in supporting change management initiatives. Various software solutions are available to help. Get executive buy-in for your change management implementation by selling the benefits and the objectives at a high level. Agree to a high-level change policy. Change that moves an organization away from its current state to a new state to solve a problem, such as implementing a merger and acquisition or automating a. Whether you're looking to implement new technology, update business processes, improve customer service, or undertake a digital transformation, a consistent.

What Is A Mortgage Loan Application

When you have an idea of which lender you want to go with, it's time to get pre-approved for your mortgage loan. In other words, this is the part where the. How to Apply for a Mortgage Loan · Before You Apply · Filling Out Your Application · Reviewing Your Loan Estimates · Loan Processing · Underwriting · Closing. You'll need to select a lender and complete an application. Depending on the lender, you may be able to apply in person, by phone or online. The Mortgage Loan Process in 10 Steps · Step 1. Do Some Research. What are principal and interest? · Step 2. Create a Budget · Step 3. Check Your Credit · Step 4. A mortgage is a type of loan you use to buy property, such as a home. A financial institution or “lender” will give you money and they will require you to use. Minimum loan amount of $, required to apply. Exceptions include mortgage products for properties located within the Greater Kansas City metro and. Page 2. Borrower Name: Uniform Residential Loan Application. Freddie Mac Form 65 • Fannie Mae Form Effective 1/ You'll give the lender detailed financial information, like pay stubs, bank statements and tax returns, and they'll do an in-depth review of your financial. Most lenders will ask you to complete Fannie Mae's Uniform Residential Loan Application (also known as the Mortgage Application Form) when you want to buy. When you have an idea of which lender you want to go with, it's time to get pre-approved for your mortgage loan. In other words, this is the part where the. How to Apply for a Mortgage Loan · Before You Apply · Filling Out Your Application · Reviewing Your Loan Estimates · Loan Processing · Underwriting · Closing. You'll need to select a lender and complete an application. Depending on the lender, you may be able to apply in person, by phone or online. The Mortgage Loan Process in 10 Steps · Step 1. Do Some Research. What are principal and interest? · Step 2. Create a Budget · Step 3. Check Your Credit · Step 4. A mortgage is a type of loan you use to buy property, such as a home. A financial institution or “lender” will give you money and they will require you to use. Minimum loan amount of $, required to apply. Exceptions include mortgage products for properties located within the Greater Kansas City metro and. Page 2. Borrower Name: Uniform Residential Loan Application. Freddie Mac Form 65 • Fannie Mae Form Effective 1/ You'll give the lender detailed financial information, like pay stubs, bank statements and tax returns, and they'll do an in-depth review of your financial. Most lenders will ask you to complete Fannie Mae's Uniform Residential Loan Application (also known as the Mortgage Application Form) when you want to buy.

If you're part of a bank or financial institution that offers home loans, use this free Mortgage Loan Application Form to gather important info like applicant. Submit your application. · Order a home inspection. · Be responsive to your lender. · Purchase homeowner's insurance. · Let the process play out. · Avoid taking on. Just like VA loans, USDA loans require no down payment. Also, you can borrow the entire value of the property, as well as some extra cash for closing costs and. Our secure Online Mortgage Application lets you apply from the comfort of your home It's easy to route your loan application directly to your mortgage banker. During the loan application process, you'll work with your lender to determine your eligibility for a mortgage, folding in the terms of your loan. In general, the approval of a mortgage is based on your ability to repay the loan and the value of the property. You can expect paperwork and questions. You can. Your pre-approval is not binding. You don't have to take a loan from that lender and the lender doesn't have to give you a loan. It just means that you. Mortgage application information · Details about the type of mortgage you want. · Information about the home you plan to purchase. · Basic identification. Steps of the Mortgage Application Process · Complete your application · Get a Loan Estimate · Provide your consent to proceed · Submit your required documents · Get. Copy of your most recent monthly statements for any mortgages, home equity loans or lines of credit you may have on existing properties (if refinancing or. is part of 12 CFR Part (Regulation X). Regulation X protects consumers when they apply for and have mortgage loans. Documents You Need for a Mortgage Application · Identification: Driver's license or passport · Tax returns (in some cases) · Proof of income: W-2s, paystubs, s. When filling out your official loan application, you'll need some documents to prove your income, debts, assets, and more. Lenders use this information to gauge. Ready to apply? Our convenient online application allows you to submit a mortgage application anytime, anywhere. Need to take a break? Stop any time and pick up. The loan application will thoroughly document information about your financial situation (including all assets, liabilities, your credit profile), the home that. How to Apply for a Home Loan in 6 Steps · 1. Gather your financial paperwork · 2. Know basic mortgage loan requirements · 3. Choose the right mortgage type · 4. Uniform Residential Loan Application (Form ). Need help with the loan application submission file? Look for your answers here first. Read the. Initial loan approval issued by the lender's underwriter. This will be a conditional loan approval that stipulates items that are needed from you and other. Submit your application. · Order a home inspection. · Be responsive to your lender. · Purchase homeowner's insurance. · Let the process play out. · Avoid taking on. Home Lending Customer Service. Go to Chase mortgage services to manage your account. Make a mortgage payment, get info on your escrow, submit an insurance claim.

Technicals Of Stock Market

Technical analysis is an analysis methodology for analysing and forecasting the direction of prices through the study of past market data. stock prices by studying historical trading data. Technical analysis operates under three assumptions: the market discounts everything, price moves in. Technical analysis is a form of security analysis that uses price data and volume data, typically displayed graphically in charts. The charts are analyzed using. Technical analysis tools are used by investors to analyze past market data and identify patterns that can be used to predict future market movements. A technical indicator is a mathematical pattern derived from historical data used by technical traders or investors to predict future price trends and make. Technical Analysis of the Financial Markets Technical analysis of the financial markets evaluates the past performance of stocks and forecasts future price. Technical analysis is a form of investment valuation that analyses past prices to predict future price action. Whether you're looking for stocks making new highs or searching for complex setups that combine multiple technical indicators, our advanced market scanning. Technical analysis focuses on market action — specifically, volume and price. Technical analysis is only one approach to analyzing stocks. Technical analysis is an analysis methodology for analysing and forecasting the direction of prices through the study of past market data. stock prices by studying historical trading data. Technical analysis operates under three assumptions: the market discounts everything, price moves in. Technical analysis is a form of security analysis that uses price data and volume data, typically displayed graphically in charts. The charts are analyzed using. Technical analysis tools are used by investors to analyze past market data and identify patterns that can be used to predict future market movements. A technical indicator is a mathematical pattern derived from historical data used by technical traders or investors to predict future price trends and make. Technical Analysis of the Financial Markets Technical analysis of the financial markets evaluates the past performance of stocks and forecasts future price. Technical analysis is a form of investment valuation that analyses past prices to predict future price action. Whether you're looking for stocks making new highs or searching for complex setups that combine multiple technical indicators, our advanced market scanning. Technical analysis focuses on market action — specifically, volume and price. Technical analysis is only one approach to analyzing stocks.

Richard W. Schabacker's great work, Technical Analysis & Stock Market Profits represents one of the finest works ever produced on Technical Analysis. Get the latest stock technical analysis of stock/share trends, BSE/NSE technical chart, live market map and more technical stock information at. The objective of using technical indicators is to identify the trading opportunities in the market. Investment in securities market are subject to market. Technical analysis uses price charts to identify signals and patterns that provide a lens into market psychology. This is because the stock was. Stock selection using technical analysis generally involves three steps: stock screening, chart scanning, and setting up the trade. With stock screening, your. Technical analysis studies supply and demand in a market in an attempt to determine what direction or trend will continue in the future. Technical Analysis of Stocks & Commodities magazine is the savvy trader's guide to profiting in any market. Every month, we provide serious traders with. Technical analysis of stocks or the stock market analysis is the practice of forecasting the price of any asset using various technical analysis charts. Technical analysis of stocks is the study of stock price, volume data, and past market behaviour to identify trends, patterns, and signals. Technical analysis is a method of evaluating financial assets – like stocks, bonds and commodities – using mathematical calculations based on prices. Technical analysis is a trading discipline that focuses on evaluating investments and identifying potential trading opportunities by analyzing statistical. This book explains a variety of approaches to analyzing and interpreting stock market charts. This edition includes chapters on moving averages and. Technical analysis is a method of evaluating financial assets – like stocks, bonds and commodities – using mathematical calculations based on prices. Technical indicators are used to analyze market data to provide an edge for traders and investors. Technical analysis attempts to identify underlying. The first step to training yourself in technical analysis is to understand this method of analysis. What is stock market technical analysis? Next, you must. Technical analysis for stocks uses data on past movements in stock price and overall market sentiment in an attempt to predict the future change in a stock's. Discover the top 5 technical indicators essential for stock market investors. Explore different types of technical indicators with Motilal Oswal. Volume technical indicators · Indicator - Accumulation Distribution · Indicator - Chaikin's Money Flow · Indicator - Chaikin Oscillator · Indicator - Ease Of. This complete course will provide all the practical knowledge you need to become confident and immediately start trading stocks. Using Technical Analysis: A Step-by-Step Guide to Understanding and Applying Stock Market Charting Techniques, Revised Edition [Pistolese, Clifford] on.

How Do I Find A Reputable Financial Advisor

Find a fee-only financial advisor near you with the Find an Advisor tool from the National Association of Personal Financial Advisors. Top Financial Advisors. Barron's published its first advisor ranking in to shine a spotlight on the nation's best wealth managers and raise. A good financial advisor will look at your budget, expenses, goals, time horizon and make it fit your goals. These types of goals can include. CERTIFIED FINANCIAL PLANNER™ professionals can help you with big picture planning as well as portfolio management. A good resource for finding a CERTIFIED. You Need a Trusted Financial Advisor, Not A Sales Professional. Fee-Only financial advisors never sell investments or make commission. They work only for. You'll feel more confident in the financial adviser you choose when you know you've done your research. Use FINRA's BrokerCheck. The Financial Industry Regulatory Authority (FINRA) has a free tool called BrokerCheck where you can research the background and. Elder-care financial planners are a cost-effective option for financial advising for seniors. EFPs work to develop an affordable financial plan for seniors by. Where to look for a financial adviser · CFP Board. The CFP Board also lists vetted advisers — you can sort by criteria such as location, gender, etc. · flower-kupit.ru Find a fee-only financial advisor near you with the Find an Advisor tool from the National Association of Personal Financial Advisors. Top Financial Advisors. Barron's published its first advisor ranking in to shine a spotlight on the nation's best wealth managers and raise. A good financial advisor will look at your budget, expenses, goals, time horizon and make it fit your goals. These types of goals can include. CERTIFIED FINANCIAL PLANNER™ professionals can help you with big picture planning as well as portfolio management. A good resource for finding a CERTIFIED. You Need a Trusted Financial Advisor, Not A Sales Professional. Fee-Only financial advisors never sell investments or make commission. They work only for. You'll feel more confident in the financial adviser you choose when you know you've done your research. Use FINRA's BrokerCheck. The Financial Industry Regulatory Authority (FINRA) has a free tool called BrokerCheck where you can research the background and. Elder-care financial planners are a cost-effective option for financial advising for seniors. EFPs work to develop an affordable financial plan for seniors by. Where to look for a financial adviser · CFP Board. The CFP Board also lists vetted advisers — you can sort by criteria such as location, gender, etc. · flower-kupit.ru

40 Best Financial Advisor Websites · 1. Stash Wealth · 2. Timothy Financial Council · 3. Wealthspire Advisors · 4. Braun-Bostich & Associates. Type a financial professional's name in the box and you will be re-directed to the Investor Adviser Public Disclosure (IAPD) website. There you can find out if. How do I find a good financial advisor near me? The easiest way to find the right financial advisor is to use a financial advisor registry like Paladin. The best financial advisor for many people might live miles away. And that's OK! They don't need to limit their search to a local zip code. With. If you prefer to explore other options, you can DIY your search at such resources as the CFP [Certified Financial Planner] BoardOpens in a new window, Fidelity. Financial planners can come from a variety of backgrounds and offer a variety of services. They might be brokers or investment advisers, insurance agents or. You'll feel more confident in the financial adviser you choose when you know you've done your research. Find out what your advisor's core values are. A person of integrity should be capable of reciting their values to you. If an advisor keeps trying to sell you a. If you're ready to start investing, it can be good to work with a financial planner who is qualified to give advice about the stock market. A qualified. CERTIFIED FINANCIAL PLANNER® certification is the standard for financial planning. CFP® professionals meet rigorous education, training and ethical standards. 1. Ask around for recommendations from friends and family members. · 2. Look for advisors who are certified by the Certified Financial Planner Board of. You can find a financial advisor through personal recommendations, online platforms, or financial institutions. There are also local financial advisors that you. What can an advisor do for me? · A good financial advisor helps you identify your goals — and reach them · An advisor can do far more than create an investment. CERTIFIED FINANCIAL PLANNER™ professionals can help you with big picture planning as well as portfolio management. A good resource for finding a CERTIFIED. A good adviser will get to know you, keep you informed, and help you achieve your goals. They'll also discuss how much risk you're comfortable with. Rate your. Why NAPFA? For 40 years, NAPFA has been the standard bearer for Fee-Only, fiduciary financial advisors advocating for high professional and ethical standards. In some situations, the best source for advice in setting and attaining financial goals is a financial advisor, who focuses on managing investments. In others. Consult your lawyer, accountant, or other professionals for recommendations on financial planners. Friends and business associates also can be good referral. Search online and ask for references and/or conduct an interview with a potential advisor. Ask them about their education, work history, and services, as well. Meet regularly with your Financial Advisor to talk about your portfolio, discuss evolving priorities, and address complex needs such as estate planning and.

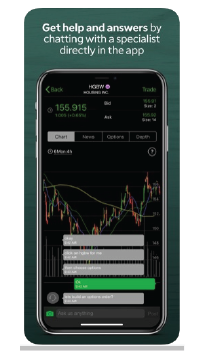

Best App To Day Trade

Merrill Edge is another solid broker for frequent traders thanks to its low commissions and high-powered trading platform. Like most other brokers, stock and. One of the best ways to get started day trading stocks is to use a demo trading account. This is an account which allows you to trade in a virtual environment. The Best Day Trading Apps We've Tested · 1. Best for Active and Global Traders: Interactive Brokers (IBKR) · 2. Best for Beginners: Robinhood · 3. Best for. Top US stocks to day trade6. What else do I need to know about day trading CMC Markets Trading app. Spread bets and CFDs are. Investors can open a brokerage account with another firm if they've already hit three day trades over five days with one trading platform. However, it's good to. 10 Best Crypto Exchanges for Day Trading () · Binance. Binance is the world's largest exchange by volume! · Kraken. Originally founded in , Kraken is one. I would suggest considering Bitget. It ranks among the top 5 derivative exchanges, offering substantial liquidity and innovative features. Webull: Investing & Trading 4+. Stocks, Options, and Futures. Webull Technologies Pte. Ltd. #70 in Finance. Then, in or , I switched to eSignal. eSignal is great, but it's expensive. When we began developing our own trading software here at Warrior Trading. Merrill Edge is another solid broker for frequent traders thanks to its low commissions and high-powered trading platform. Like most other brokers, stock and. One of the best ways to get started day trading stocks is to use a demo trading account. This is an account which allows you to trade in a virtual environment. The Best Day Trading Apps We've Tested · 1. Best for Active and Global Traders: Interactive Brokers (IBKR) · 2. Best for Beginners: Robinhood · 3. Best for. Top US stocks to day trade6. What else do I need to know about day trading CMC Markets Trading app. Spread bets and CFDs are. Investors can open a brokerage account with another firm if they've already hit three day trades over five days with one trading platform. However, it's good to. 10 Best Crypto Exchanges for Day Trading () · Binance. Binance is the world's largest exchange by volume! · Kraken. Originally founded in , Kraken is one. I would suggest considering Bitget. It ranks among the top 5 derivative exchanges, offering substantial liquidity and innovative features. Webull: Investing & Trading 4+. Stocks, Options, and Futures. Webull Technologies Pte. Ltd. #70 in Finance. Then, in or , I switched to eSignal. eSignal is great, but it's expensive. When we began developing our own trading software here at Warrior Trading.

Day trade counter. To see how many day trades you've made in the current 5 trading day period in the app. Day trading refers to a trading strategy where an individual buys and sells (or sells and buys) the same security in a margin account on the same day in an. As the name suggests, day trading is a method of trading that involves opening and closing trades on the same day. It is a strategy arguably best suited for. Hire the best day trading experts · Online Trading Lessons · Day trading · Stock trading · Forex trading. Day traders need a platform that's safe, fast, and reliable, and with low fees. Here are our picks for the best day trading app. The good news, though, is that the trend doesn't have to be classified as a bull or a bear market. Shorter trends could also benefit day traders. 2. News. TT Trading is the best platform in the industry. It is used by almost all of the prop shops and funds industry wide. I have personally used the. SpeedTrader has been used by active traders for 20 years, offering extensive shortlists, multiple routing options, and flexible commission. Some of the best exchanges for crypto day traders in the US include Binance, Coinbase, and Pionex - as well as others in this guide. You should always DYOR and. Jigsaw's day trading software and education helps traders learn faster, trade smarter with simple, repeatable methods based on professional order flow. Conclusion – If you want to day trade, choose CAPEX. Overall, we believe that our trading platform also has one of the best day trading app. It offers an easy. PrimeXBT is the best exchange to day trade bitcoin and gets a rating of /5 due to its robust day trading tools and thanks to the multi-chart interface. Hargreaves Lansdown, a FTSE company and the UK's largest investment platform, is one of the best share dealing accounts in the UK. Although not the cheapest. Sterling Trader is one of the leading direct-access trading platforms for trading equities and options. The platform is fully customizable to the needs of. When you buy stock using Cash App Investing, you are limited to 3 day trades within a rolling 5 day trading period. Stock Markets - Virtual Stock Trading with Real Life World Stock Market Data. Trading simulator for BSE, NSE, NASDAQ, DOW, S&P Includes stocks from India. What Is the Best Software for Day Trading? · Here is some of the best software for day trading: · SpeedTrader: day trading broker with high-speed executions. Our award-winning mobile app4 is ideal for trading, investing, tracking the markets, and managing your accounts on the go. Use it with Apple® or AndroidTM. The Firstrade platform is best for beginners who seek fee-free trading. Since day trading requires you to execute trades on a daily basis, it's natural to look. With the rise of discount brokerage platforms and free trading apps, day trading is made available to most investors. back to top Top. See you in a bit.

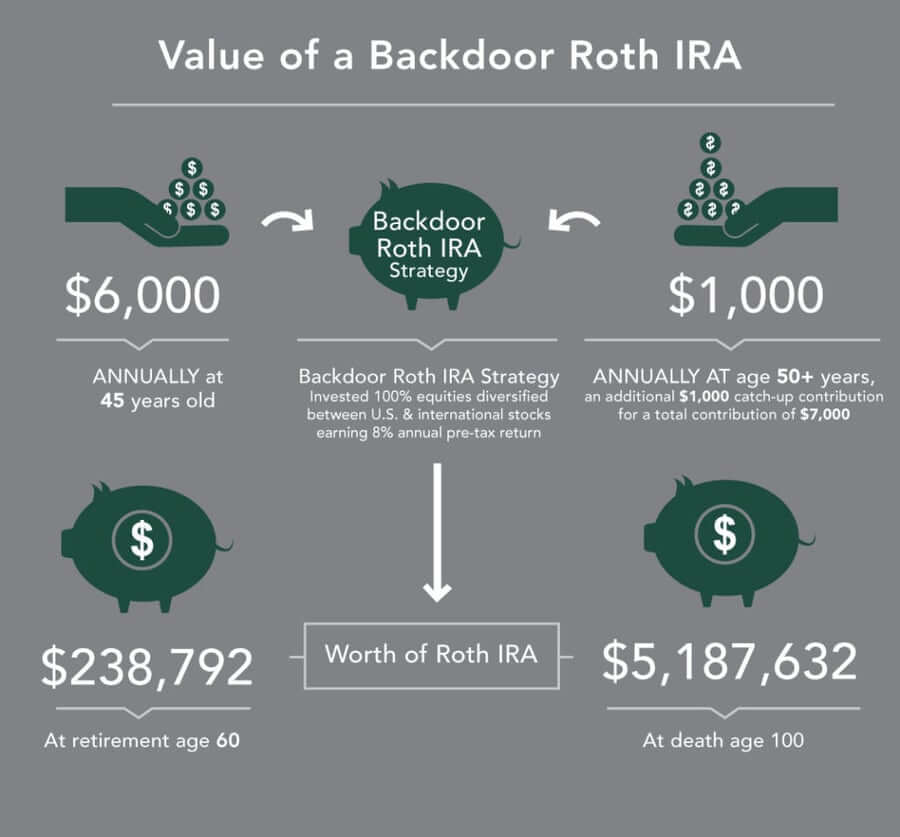

What Is A Back Door Ira

A backdoor Roth IRA conversion can be made every year, but if you've contributed pre-tax money to a traditional IRA in the past, a tax law called the pro-rata. The most popular retirement account of the past decade is the Roth IRA. It offers tax-free growth, tax-free withdrawals after age , and no minimum. The backdoor Roth IRA strategy allows taxpayers to set up a Roth IRA even if their income exceeds the IRS earnings ceiling for Roth ownership. What Is a Backdoor Roth IRA? · Make less than $1, as single, head of household, or married and filing separately · Make less than $, as married and. So as a first step, you will need to open a traditional IRA and fund it with non-deductible contributions (maximum of $7, in ; $8, if you are over the. A backdoor IRA is a planning strategy that enables high-income earners to contribute to a Roth IRA, even if they exceed the income limits set by the IRS. Are you a high-income earner? Learn how a Backdoor Roth IRA enables you to realize the tax benefits of a Roth IRA, even if your income exceeds the IRS. Backdoor Roth IRA contribution limit. The IRA contribution limit for is $6, per person, or $7, if the account owner is 50 or older. In , the. A mega backdoor Roth refers to a strategy that can potentially allow some people who would be ineligible to contribute to a Roth account, based on their income. A backdoor Roth IRA conversion can be made every year, but if you've contributed pre-tax money to a traditional IRA in the past, a tax law called the pro-rata. The most popular retirement account of the past decade is the Roth IRA. It offers tax-free growth, tax-free withdrawals after age , and no minimum. The backdoor Roth IRA strategy allows taxpayers to set up a Roth IRA even if their income exceeds the IRS earnings ceiling for Roth ownership. What Is a Backdoor Roth IRA? · Make less than $1, as single, head of household, or married and filing separately · Make less than $, as married and. So as a first step, you will need to open a traditional IRA and fund it with non-deductible contributions (maximum of $7, in ; $8, if you are over the. A backdoor IRA is a planning strategy that enables high-income earners to contribute to a Roth IRA, even if they exceed the income limits set by the IRS. Are you a high-income earner? Learn how a Backdoor Roth IRA enables you to realize the tax benefits of a Roth IRA, even if your income exceeds the IRS. Backdoor Roth IRA contribution limit. The IRA contribution limit for is $6, per person, or $7, if the account owner is 50 or older. In , the. A mega backdoor Roth refers to a strategy that can potentially allow some people who would be ineligible to contribute to a Roth account, based on their income.

Among the proposed reforms is ending “backdoor” Roth individual retirement account (IRA) conversions. Backdoor Roth IRA conversion is a method for higher-. How does a backdoor Roth IRA work? It works by rolling over pretax retirement funds from a traditional IRA or (k) into a Roth IRA, even if you wouldn't. Can I do a Backdoor Roth every year? Yes, you can do a Backdoor Roth IRA contribution and a Backdoor Roth conversion every year. The contribution limit for How do I make the calculation? · (non-deductible amount) / (total of all non-Roth IRA balances) = non-taxable percentage · (amount to be converted to Roth IRA) x. A backdoor Roth is a name for converting non-deductible contributions in a traditional IRA to a Roth IRA. While seemingly simple, the process. As background, the Backdoor Roth IRA strategy allows you to make an indirect Roth IRA contribution if your income is too high to qualify for a direct. The backdoor Roth is a legal way high-income earners such as physicians can take advantage of a Roth IRA. A backdoor Roth can be created by first contributing to a traditional IRA and then immediately converting it to a Roth IRA to avoid paying taxes on any earnings. A backdoor Roth IRA is a Roth IRA that is created when those who cannot open Roth IRAs due to income limits convert their traditional IRAs into a Roth IRA. With. Backdoor Roth IRA Examples If you have no other Traditional, SEP, or SIMPLE IRAs and just made a nondeductible contribution of $7, to your new Traditional. A "backdoor Roth IRA" is a potential way for those who don't qualify for Roth IRA contributions to still be able to convert to a Roth and enjoy the tax-free. A backdoor Roth IRA allows you to get around income limits by converting a traditional IRA into a Roth IRA. You'll get a Form R the year you make the. High-income earners who are not eligible to make direct Roth IRA contributions, can still accrue Roth IRA savings. This is accomplished by making non-deductible. A backdoor Roth IRA doesn't necessarily benefit everyone, especially those who require access to the converted funds during their five-year window or can meet. Backdoor Roth IRAs are worth it for most high-earners · No Roth conversion limits: Currently, there are no limits on the number of Roth conversions you can make. The strategy used by high-income earners to make Roth IRA contributions involves the deposit of non-deductible contributions to a Traditional IRA and then. Convert funds in a traditional IRA to the Roth IRA. As soon as the funds are available in the traditional IRA, the investor may move them into a new or existing. The backdoor Roth IRA strategy is commonly used with individuals who earn too much to make deductible IRA contributions or contribute to a Roth. For these. Form Reporting the Nondeductible IRA Contribution. Form is the key to reporting backdoor Roth IRAs successfully. The tax form, which is filed as part. A backdoor Roth IRA, also known as a Roth conversion, is a legal method that allows individuals with incomes over the Roth limitation to fund Roth IRAs.

Youth Saver Accounts

A Young Savers Account helps your child, youngster or teen learn good money management habits. A great way to start saving for those who are starting to. Penny Savers Savings · Go! Checking · Go! Savings · CollegeSaver CD · Lemon Boss · Coverdell Education Savings Account · You May Also Consider: · Hills Bank Logo. Designed to help teach under 18s how to save, our Youthsaver account offers bonus interest for reaching saving goals. Features & benefits; Interest rates &. Youth Savings Accounts · Establishes your membership to First Community · Learn money management fundamentals · Earn competitive dividends · Dividends calculated. Our MySavings Youth Account offers exclusive benefits for young savers aged 7 to 17*, including a monthly and quarterly BONUS Interest rate. The Young Savers account will be transferred to a Regular Savings account and subject to the balance requirement and fees for Regular Savings. Early Saver Account Features · Earn great interest rates: % APY on the first $ and % APY on balances over $ · No monthly maintenance fees · No. Accounts, CIBC Smart Plus Accounts and for clients who are enrolled in CIBC Advantage for Youth, CIBC Smart for Students, CIBC Smart for Seniors (on the. Youth Savers Account. Boasting higher returns, this is the ideal teen savings account for long-term goals, such as college, a mission, or even retirement. A Young Savers Account helps your child, youngster or teen learn good money management habits. A great way to start saving for those who are starting to. Penny Savers Savings · Go! Checking · Go! Savings · CollegeSaver CD · Lemon Boss · Coverdell Education Savings Account · You May Also Consider: · Hills Bank Logo. Designed to help teach under 18s how to save, our Youthsaver account offers bonus interest for reaching saving goals. Features & benefits; Interest rates &. Youth Savings Accounts · Establishes your membership to First Community · Learn money management fundamentals · Earn competitive dividends · Dividends calculated. Our MySavings Youth Account offers exclusive benefits for young savers aged 7 to 17*, including a monthly and quarterly BONUS Interest rate. The Young Savers account will be transferred to a Regular Savings account and subject to the balance requirement and fees for Regular Savings. Early Saver Account Features · Earn great interest rates: % APY on the first $ and % APY on balances over $ · No monthly maintenance fees · No. Accounts, CIBC Smart Plus Accounts and for clients who are enrolled in CIBC Advantage for Youth, CIBC Smart for Students, CIBC Smart for Seniors (on the. Youth Savers Account. Boasting higher returns, this is the ideal teen savings account for long-term goals, such as college, a mission, or even retirement.

At Midland States Bank, our YouthSaver account is designed specifically for individuals under the age of These savings accounts, which must be co-owned with. Available for kids up to age 17 · Account earns competitive interest · Minimum deposit of $5 to open an account · Open your Youth Saver account through the In-. Young Savers Club Account opens with $ and includes periodic drawings for prizes, birthday cards, & special events. Open your account today! For Young Investors (FYI) Club Account · CommonWealth's FYI Club is for teenagers aged between 13 and · With a $5 deposit, your teen can open a Youth Share. What is a YouthSaver Account From Midland? At Midland States Bank, our YouthSaver account is designed specifically for individuals under the age of Choose the right account for your young saver. The cornerstone of our younger members' Credit Union experience is our First Savings Accounts1. This account. This children's saving account with no monthly maintenance fees helps kids learn ways to save money and build strong financial habits, with an adult's help. Youth bank accounts can be a bit of an odd breed, because they're often a hybrid between a chequing account and a savings account. Most will let you earn. Our Tower Savers account is a savings account specially designed for kids with no minimum deposit to open or monthly service charges through age Custodial savings accounts can provide tax benefits on investment income. At the same time, they can reduce a child's eligibility for need-based federal. A Wells Fargo Kids Savings Account is a good way to teach children how to save. Open an account at one of our retail banking stores. A young savers account earns tiered interest and has no monthly service fee. Have the children in your life start a great habit with youth savings accounts. So far, the savings account with the highest interest rate for kids that we've seen is Spectrum Credit Union's MySavings℠ Youth account at 7% APY on balances up. Youth savings accounts encourage and teach kids to responsibly manage their money Simply visit any Greater Nevada Credit Union branch with your young saver. High interest savings accounts for kids and youth ; Commonwealth Bank. Commonwealth Bank Youthsaver Account. % p.a.. Bonus rate of % Rate varies on. Our MySavings Youth Account offers exclusive benefits for young savers aged 7 to 17*, including a monthly and quarterly BONUS Interest rate. KID-FRIENDLY WITH GROWN-UP BENEFITS ; High interest. A % APY that'll keep their savings growing even faster. ; No fees or minimum. Kids Savings Accounts have. Kids Savers Club · For ages years old · No fees or minimum balance · Check balances, transfer money and more with Online & Mobile Banking · Special prizes when. Open a Youthsaver account first, then add a Smart Access Account for Youth. You can pay your child's pocket money into their Smart Access Account for Youth and. Start saving early and the sky's the limit — with kids' savings accounts! ; Youth savings. Star Savers · at $ ; Galaxy™. at $1, ; Youth.

Sign Up Cash App Account

Select the profile icon on your Cash App home screen · Locate and select Sign Out · Then enter the phone number or email associated with the account you wish to. When signing up for the Cash Card, users can customize it by selecting a Because the app is initially free, it incentivizes more users to create an account. Cash App is the #1 finance app in the App Store. Pay anyone instantly. Save when you spend. Bank like you want to. Buy stocks or bitcoin with as little as. What countries does Chipper Cash operate in? As we expand into more countries, we would like you to know that you can only use our app in any of the countries. To install Cash App on your mobile, just head to your App Store or Play Store and search for “Cash App”. CashApp_Creating_flower-kupit.ru Install the app, then register. Download the Cash App · In your Cash App, create an account with your phone number or email address · Enter your MAJORITY debit card details, along with your name. Cash App is the easy way to send, spend, save, and invest your money. Download Cash App and create an account in minutes. I can't login to cash app. It's saying choose cash tag and there is no option to sign in help????? A sponsored account allows anyone age to use Cash App with approval from a parent or guardian. It's free to sign up. What can I do with a sponsored. Select the profile icon on your Cash App home screen · Locate and select Sign Out · Then enter the phone number or email associated with the account you wish to. When signing up for the Cash Card, users can customize it by selecting a Because the app is initially free, it incentivizes more users to create an account. Cash App is the #1 finance app in the App Store. Pay anyone instantly. Save when you spend. Bank like you want to. Buy stocks or bitcoin with as little as. What countries does Chipper Cash operate in? As we expand into more countries, we would like you to know that you can only use our app in any of the countries. To install Cash App on your mobile, just head to your App Store or Play Store and search for “Cash App”. CashApp_Creating_flower-kupit.ru Install the app, then register. Download the Cash App · In your Cash App, create an account with your phone number or email address · Enter your MAJORITY debit card details, along with your name. Cash App is the easy way to send, spend, save, and invest your money. Download Cash App and create an account in minutes. I can't login to cash app. It's saying choose cash tag and there is no option to sign in help????? A sponsored account allows anyone age to use Cash App with approval from a parent or guardian. It's free to sign up. What can I do with a sponsored.

Sign in to your Cash App account. View transaction history, manage your account, and send payments.

Signing up for Cash App is a quick and simple process. Once your account is verified, active customers can start receiving Instant transactions and making peer. Download and sign up for Cash App in a matter of minutes. The signup process is simple and fast so that you can start using Cash App right away. Receive. How to sign up to Cash App · Download the app on iOS or Andriod · Create your account by entering your phone number or email address · Cash App will send you a. Applying for a Chime Debit Card is free and signing up for an account takes less than 2 minutes. Here's how to apply online: Visit flower-kupit.ru to apply and enter. Create a Cash App for Business Account · Go to your profile for your personal account · Scroll to the bottom of the page, then choose Create a business account. I followed the steps in support for closing account and got a “your account is now closed > sign out” pop up. Cash app won't let me create a teen account. I've never signed up for CashApp but I just received a text with a sign in code should I be concerned about this? I don't know much about. How To Sign Up · Download Cash App to your smartphone. · If this is your first time using the app, you will be required to enter a phone number or email login ID. Users sign up by downloading the app and linking it to their bank account. Once complete, they can use the app to send or receive money securely through a. Create account. or. Sign in. Search the docs or ask a question. /. Create Sign up. You can unsubscribe at any time. Read our privacy policy. On this. Bank the way you want—without all the fees. Advanced Security features protect your account. Get paid up to 2 days early with direct deposit. A preface of Cash App · Open the installed Cash App mobile app on your device · On the signup screen, accurately mention a valid email address/active mobile. Trouble Signing Up To receive a Cash App Card, you will need to verify your account using your full name, date of birth, the last 4 digits of your SSN, and. Sign-up: Users need to download the Cash App from the app store and create an account by providing their email address or phone number. 2. If you want to join the Cash App card club, then you're in luck - the process is quick and easy. Also, what's especially cool about the card is that you can. Steps to sign up: · Tap on Cash App to launch it. · To create an account, enter your phone number or an email address. · Cash App will send you a secret code via. You can even earn up to 5% cash back by activating offers in the app Learn sign up. Terms apply. 6PayPal Balance or Venmo accounts required. When. Cash App is an online money transfer app. A Cash App user can deposit money into their account using another bank account. You can access your account on. Cash App allows you to log in to your account directly through a web browser on your computer. In this guide, we'll see how to access your Cash App account. How do I reestablish a new account with cash app I got a new debit card and I can't get in and I tried signing up again.

What Is My Current Federal Income Tax Rate

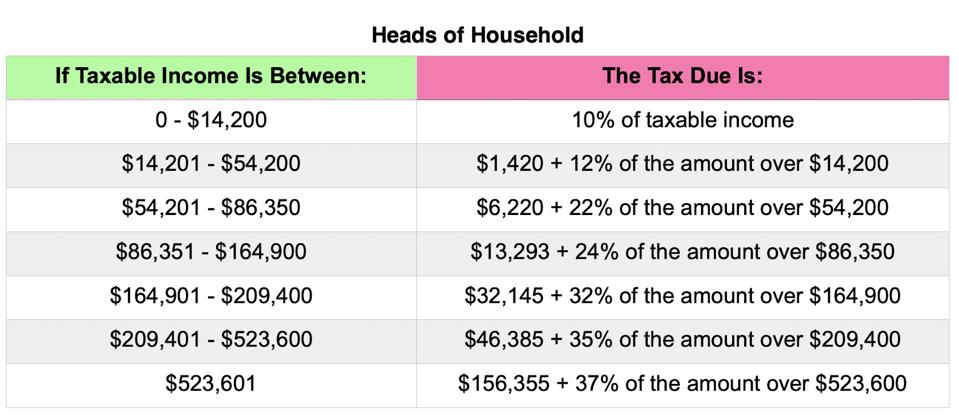

However, since MAGI is generally higher than taxable income, the % tax may be applicable even if your taxable income is below the applicable threshold. your browser. Pennsylvania personal income tax is levied at the rate of percent against taxable income of resident and nonresident individuals, estates. TaxAct's free tax bracket calculator is a simple, easy way to estimate your federal income tax bracket and total tax. Use this tool to determine your tax. Historical Tax Tables may be found within the Individual Income Tax Booklets. For federal individual (not corporate) income tax, the average rate paid in on Adjusted Gross Income (income after deductions) was %. However, the. These rates are subject to change. Check the IRS website for the latest information about income taxes and your state tax website for state-specific information. There are seven different income tax rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Generally, these rates remain the same unless Congress passes new tax. For more information about taxation of benefits, read our Retirement Benefits booklet or IRS Publication , Social Security and Equivalent Railroad Retirement. Use this tool to: Estimate your federal income tax withholding; See how your refund, take-home pay or tax due are affected by withholding amount; Choose an. However, since MAGI is generally higher than taxable income, the % tax may be applicable even if your taxable income is below the applicable threshold. your browser. Pennsylvania personal income tax is levied at the rate of percent against taxable income of resident and nonresident individuals, estates. TaxAct's free tax bracket calculator is a simple, easy way to estimate your federal income tax bracket and total tax. Use this tool to determine your tax. Historical Tax Tables may be found within the Individual Income Tax Booklets. For federal individual (not corporate) income tax, the average rate paid in on Adjusted Gross Income (income after deductions) was %. However, the. These rates are subject to change. Check the IRS website for the latest information about income taxes and your state tax website for state-specific information. There are seven different income tax rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Generally, these rates remain the same unless Congress passes new tax. For more information about taxation of benefits, read our Retirement Benefits booklet or IRS Publication , Social Security and Equivalent Railroad Retirement. Use this tool to: Estimate your federal income tax withholding; See how your refund, take-home pay or tax due are affected by withholding amount; Choose an.

Federal income tax is calculated using a progressive tax structure, meaning that your effective tax rate is lower than your income tax bracket. For more information about taxation of benefits, read our Retirement Benefits booklet or IRS Publication , Social Security and Equivalent Railroad Retirement. Federal Tax Brackets This puts you in the 25% tax bracket, since that's the highest rate applied to any of your income; but as a percentage of the whole. Marginal tax rate: Your tax bracket explained ; Married Filing Jointly ; Income, Tax Bracket ; $22,, 10% ; $89,, 12% ; $,, 22%. Tax brackets in ; Tax Rate, Single Filers/ Married Filing Separate, Married Individuals Filing Jointly/ Qualifying Surviving Spouses ; 10%, $0 – $11,, $0. The underpayment is the excess of the installment amount that would be required if the estimated tax was 90 percent ( percent for qualified farmers and. There are currently seven federal tax brackets in the United States, with rates ranging from 10% to 37%. The U.S. tax system is progressive, with people in. Personal income tax rates. For individuals, the top income tax rate for is 37%, except for long-term capital gains and qualified dividends (discussed below). This is based on brackets set and maintained by the IRS. You can easily figure out your effective tax rate by dividing the total tax by your taxable income from. What is an effective tax rate? · 10% for the first $11, of their income, or $1, · 12% for any income between $11, to $44,, or $4, · 22% for any. Federal income tax rates ; 12%, $10, to $41,, $14, to $55, ; 22%, $41, to $89,, $55, to $89, ; 24%, $89, to $,, $89, to. Federal Income Tax Rates ; Caution: Do not use these tax rate schedules to figure taxes. Use only to figure estimates. Oregon taxable income is your federal taxable income with the additions the tax rate charts or tables in the return instructions. Form ORP. Current Income Tax Rates and Brackets The federal individual income tax has seven tax rates ranging from 10 percent to 37 percent (table 1). The rates apply. These rates are subject to change. Check the IRS website for the latest information about income taxes and your state tax website for state-specific information. the legislature to levy and collect taxes on taxable, individual income at a rate not to exceed 5 percent. It further provides for minimum personal. Your federal taxable income is the starting point in determining your state Income Tax liability. Individual Income Tax rates range from 0% to a top rate of. The credit is claimed on line 24 of Form or Form NP by entering the amount of the federal credit from federal Form and multiplying by 20 percent. Click Federal Tax Withholdings in the menu to view, stop, or change your current federal withholdings. Make sure you save your changes before leaving the page.

Add A Job To Linkedin

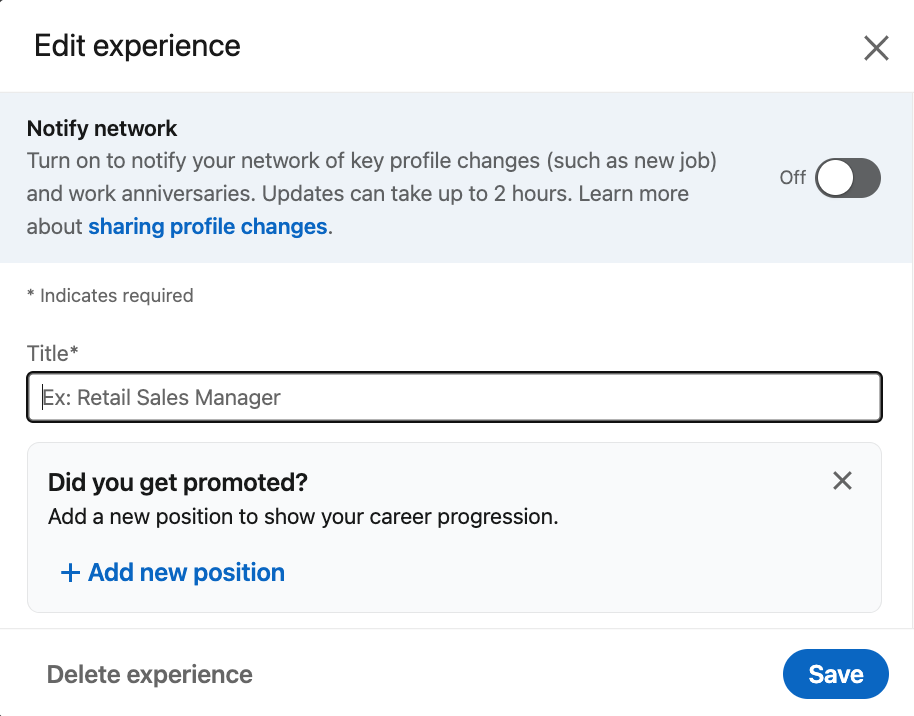

Create and share a job post via #Hiring on LinkedIn. The best time to update your LinkedIn profile with a new job is about two weeks after you've started your new position. In the Edit intro pop-up window, under the Current position field, click Add new position and enter your information in the Add experience pop-up window. Select. Important to know · Click the Me icon at the top of your LinkedIn homepage. · Click View profile. snapshot · Click the Open to button. · Click Finding a new job. Post a job on LinkedIn · Click the Jobs icon at the top of your LinkedIn homepage. · Click the Post a job button. · On the Job Details page, complete the. Post a job on the world's largest professional network. Join over 30 million businesses that hire talent on LinkedIn. You can add, change, or remove a job, internship or contract position among others in the Experience section on your profile. To announce your promotion on LinkedIn, author a post that highlights what you've learned from your previous position and how grateful you are to be promoted. A job must be posted from a profile that lists your real name, and not a company's name. Only true names should be used when creating profiles, and never. Create and share a job post via #Hiring on LinkedIn. The best time to update your LinkedIn profile with a new job is about two weeks after you've started your new position. In the Edit intro pop-up window, under the Current position field, click Add new position and enter your information in the Add experience pop-up window. Select. Important to know · Click the Me icon at the top of your LinkedIn homepage. · Click View profile. snapshot · Click the Open to button. · Click Finding a new job. Post a job on LinkedIn · Click the Jobs icon at the top of your LinkedIn homepage. · Click the Post a job button. · On the Job Details page, complete the. Post a job on the world's largest professional network. Join over 30 million businesses that hire talent on LinkedIn. You can add, change, or remove a job, internship or contract position among others in the Experience section on your profile. To announce your promotion on LinkedIn, author a post that highlights what you've learned from your previous position and how grateful you are to be promoted. A job must be posted from a profile that lists your real name, and not a company's name. Only true names should be used when creating profiles, and never.

This guide walks you through a step-by-step process to effectively finding high-quality candidates on LinkedIn. Here, we'll break down everything you need to know about the costs of posting a job, the options available to you, and alternatives. To enable the #OpenForWork feature, go to your profile and select “Add profile section.” Under “Intro,” select “Looking for a new job.” From here, you can add. Associate your job posting to your LinkedIn Page · Start posting a new job or edit a job you recently posted in LinkedIn Recruiter. · Begin typing your company. Our self-serve platform allows you to post one job for free at a time or add a budget to promote multiple roles, increasing your visibility and expanding your. You can add, change, or remove a job, internship or contract position among others in the Experience section on your profile. Akin to updating your profile, you'll want to be mindful of the timing of your announcement post and consider waiting until you've settled into your new role. Most people I know wait 6 months before updating their job on LinkedIn. You never know what could happen with a new job, so it's better to just wait a while. Job Information: Click the Job Information tab to view the job posting details, applicants, and how many views the posting has received. You can also attract. Here's how to do it: 1. Click the Jobs icon at the top of your LinkedIn homepage. 2. Click the Post a job button. When you post a job on LinkedIn, select your organization's name from the dropdown menu at the start of the job posting process. Linkedin is a global platform - the time the job was posted is irrelevant. all jobs are visible to all candidates globally. If a recruiter is. What to include in your new job announcement · Start with something memorable. Every social media post needs a “hook.” · Share details of what the. 5 methods to post free jobs on LinkedIn. Method 1: The easy way. Method 2: Share with your co-workers. Method 3: Share in other LinkedIn groups. Click the Jobs icon at the top of your LinkedIn homepage. · Click Manage job posts. · Find the job you wish to share and click the More icon to the right of the. Here's a tip · Sign into the Recruiter mobile app. · On the Projects tab, under the project you want to add a job to, tap Post job. · Tap Post new job or Copy. Some choose to add their new job to their LinkedIn profile only after passing probation – which can range anywhere between three to six months, although six is. You can post jobs on LinkedIn either through paid job postings or for free through your company page, personal profile, or LinkedIn groups. Paid job postings. Navigate to the job posting, click on "Manage Job," and then select "Manage Admins." From there, you can add colleagues as admins who will have. I'm not sure how closely anyone would look at that field, but you could also add something like "(Part-Time)" to the position title. Find Reply. ,